Thirty Congress members have supported a bill that would prevent federal officials and political employees from using prediction markets that could be influenced by insider information.

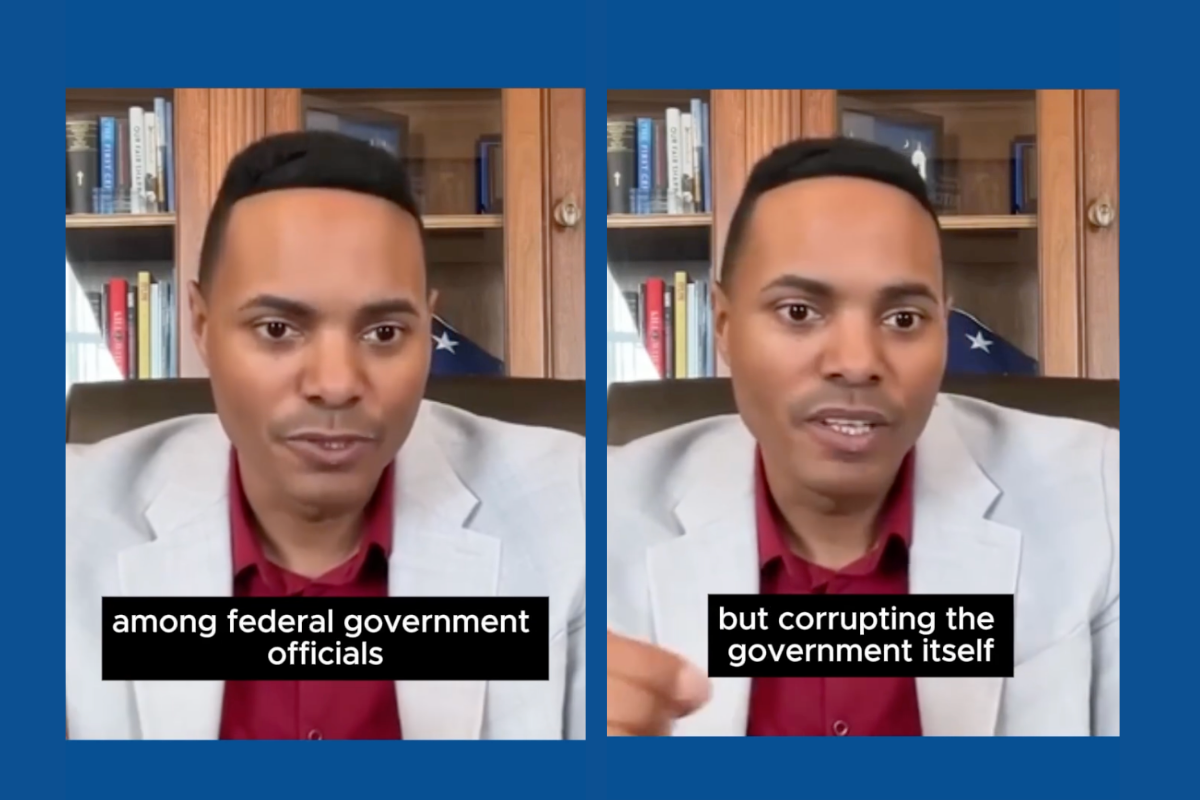

After an anonymous Polymarket user cashed out with over $400,000 on a trade related to the operation to depose Venezuelan President Nicolás Maduro, concerns were raised that the bet was placed using insider information. Now in a release seen by ReadWrite, Representative Ritchie Torres has introduced the Public Integrity in Financial Prediction Markets Act of 2026 into the House of Representatives, gaining support from 30 Members of Congress.

The bill would prohibit federal elected officials, political appointees, Executive Branch employees, and congressional staff from buying, selling, or exchanging prediction market contracts tied to government policy, government action, or political outcomes when they are privy to non-public information or could reasonably obtain such information through their work.

Kalshi CEO, Tarek Mansour, previously said he would support a bill that would ban government officials from using prediction markets.

Congress support comes from the left

Support for the bill comes from the Democrats, with co-sponsors including Speaker Emerita Nancy Pelosi among many others.

“The most corrupt corner of Washington DC may well be the intersection of prediction markets and the federal government, where insider trading and self-dealing are no longer imagined risks but demonstrated dangers,” said Representative Torres. “We ignore this plain-sight corruption at our own peril. Imagine, for a moment, a member of the Trump Administration were to place a bet predicting an event like the removal of Nicolás Maduro.

“As both a government insider and a participant in the prediction markets, that individual would face a perverse incentive to personally push policies that line his pockets. Prediction-market profiteering by government insiders must be prohibited – period.”

Torres went on to specifically mention President Donald Trump “using crypto to enrich himself and his family“.

“There is reason to fear that Trump or his associates could do the same when it comes to prediction markets,” he continued. “No elected official is elected to profit from elected office. Government is not a for-profit enterprise; it is a public trust. It does not belong to the elected officials. It belongs to the people who elect them.”

In light of recent betting activity surrounding the capture of President Nicolás Maduro, I have serious concerns about @Polymarket’s ability, and willingness, to comply with @CFTC regulations.

I am demanding answers from Polymarket CEO @shayne_coplan regarding the safeguards… pic.twitter.com/fHpjLpsykG

— Dina Titus (@repdinatitus) January 9, 2026

At the same time, Democratic Rep. Dina Titus, who’s been pushing to reform gambling laws through her FAIR BET Act, sent a letter to Polymarket CEO Shayne Coplan asking some tough questions. She wants to know what safeguards the company has in place to stop insider trading and make sure its markets are being run fairly and transparently.

In the correspondence, she wrote: “In the days leading to Venezuelan President Nicolas Maduro’s capture, traders on Polymarket placed sizable wagers on a contract predicting whether Maduro would leave office before the end of January 2026. One wager, reportedly of $32,000, resulted in profits exceeding $400,000. While it remains unclear whether these wagers constituted insider trading, their timing raises serious questions and highlights the need for robust surveillance, compliance, and enforcement mechanisms.”

Featured image: Polymarket / Wikimedia Commons licensed under CC BY-SA 4.0

The post 30 Congress members support bill to block political insider trading after Maduro Polymarket controversy appeared first on ReadWrite.